Virtual Power Purchase Agreements 101: Your Questions Answered

Welcome to Trio Toolbox, a 101 learning series to help you navigate the clean energy transition. Created by our teams of subject matter experts, we provide you with the critical information, insights, and analysis you need across all things energy and sustainability.

What is a Power Purchase Agreement?

A Power Purchase Agreement (PPA) is a contract signed between an offtaker and an electricity generator, which can be a utility, government entity, or developer. In a PPA, the offtaker pays an agreed-upon price for the energy generated by the proportion of the project specified in the contract over a set period, typically ranging from 10 to 20 years. In return, the offtaker receives the energy, or its value, generated by the project and the Renewable Energy Certificates (RECs) associated with the project owned by the seller. These contracts are usually finalized before the project is constructed, enabling the project developer to secure financing.

What is a Virtual Power Purchase Agreement?

There are two main types of PPAs available: physical and virtual.

In a physical PPA, the offtaker pays a predetermined fixed price for (1) the physical energy generated by a project and (2) the associated RECs. The physical energy received directly meets the buyer’s load at or near the project delivery point.

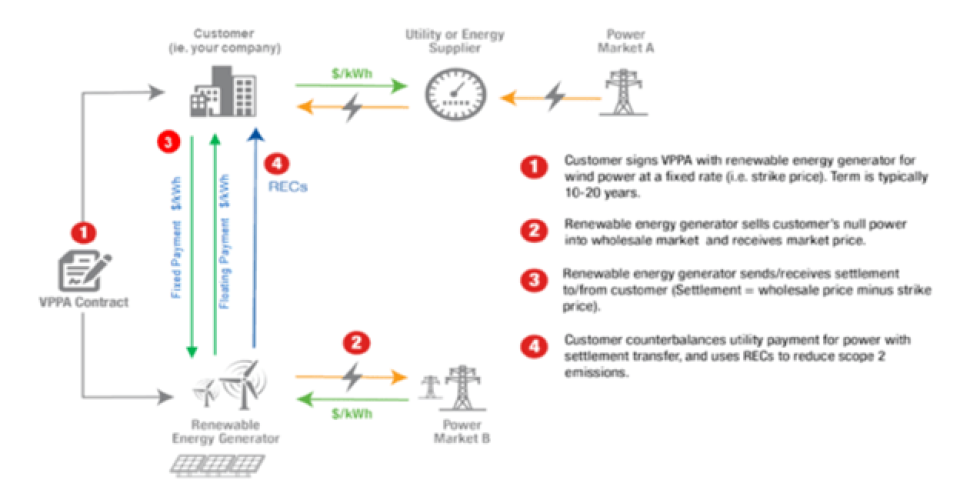

A virtual PPA (VPPA), or financial PPA, is a purely financial agreement; it is a fixed-for-floating contract-for-differences. Simply put, when compared to a physical PPA, only the project RECs are delivered to the offtaker, while the energy generated from the project is sold into the market and the buyer receives the value. Rather than paying a fixed price for the delivery of energy, the offtaker agrees to participate in a fixed-for-floating swap.

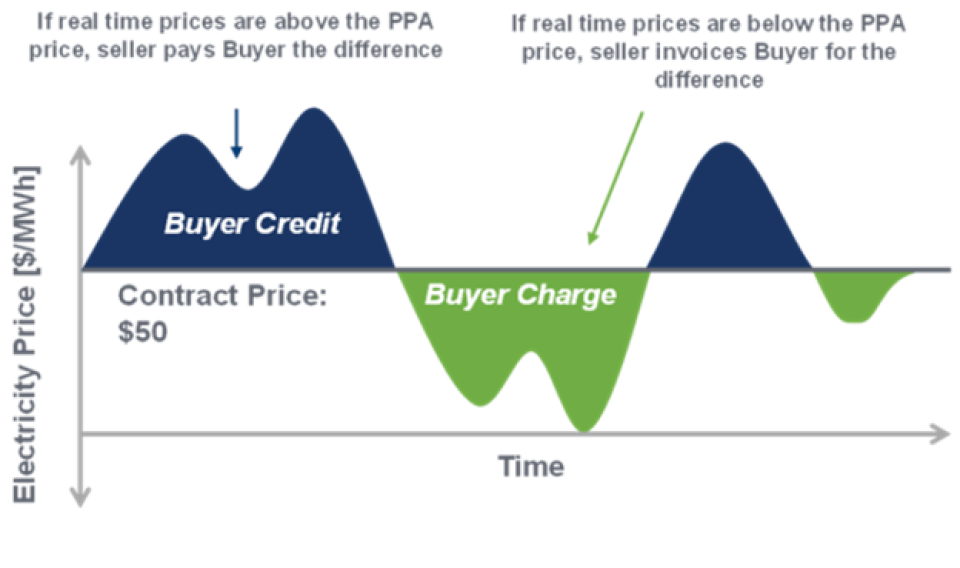

Within this swap, the developer sells energy from the project into the wholesale electricity market at the floating market price at an agreed-upon settlement location. During settlement periods where the floating market price is below the agreed-upon fixed price (or strike price), the offtaker pays the seller the difference, resulting in a negative settlement. Conversely, in periods where the floating market price is above the VPPA price, the seller pays the offtaker the difference, resulting in a positive settlement. See below for an overview and example of these settlements:

What are the benefits of a VPPA?

The primary motivation for an organization to sign a VPPA is to obtain the associated RECs, which may be used to reduce the offtaker’s Scope 2 emissions. Given the unpredictability of REC prices and the dynamic supply of RECs, securing a predictable source of RECs at a stable cost for an extended period of time is a significant advantage. However, beyond emissions reduction, there are other reasons for an organization to consider entering into a VPPA.

One notable aspect of a VPPA is the associated additionality claims. When an organization signs a VPPA with a developer, it provides a guaranteed source of revenue for the associated project. This financial assurance enables the developer to secure financing for the planning and construction of the project. The concept that an organization’s signing of a VPPA facilitates the entry of a new renewable energy project onto the grid is known as additionality and can significantly enhance an organization’s renewable energy claims.

Given that a VPPA can be signed for a project outside of a system in which the offtaker has electricity demand, an organization can help bring online renewable energy onto grids that are even dirtier than its own, making a greater impact than a physical PPA in some cases. There are also significant positive impacts to local communities where these contracts are signed.

Finally, VPPAs offer the potential for positive cash flows. Many of the other options available to organizations with renewable energy goals will always come at a net cost to the buyer. While most markets are currently forecasted to have net negative cash flows for VPPAs, there is the potential for positive cash flows when market prices are above the strike price.

Who can enter into a VPPA?

The advent of VPPAs has allowed corporations to become much bigger players in the renewable energy space. Because VPPAs are easily scalable and the associated RECs may be used to reduce a larger portion of scope to emissions, they are an important tool for corporations seeking to meet their sustainability goals, with some of the strongest claims available. Offtakers, whether possessing a singular substantial load center (e.g., data centers) or multiple smaller load centers (e.g., retailers) that can be aggregated, have the option to utilize a VPPA for comprehensive coverage. The combination of RECs, additionality claims, and local impact created by the renewable energy project tell a great story and create a lasting partnership between the offtaker and the developer.

However, these deals can be complex to negotiate, and the market can be difficult to navigate. The Trio team leverages its expertise to navigate deals and address strategic questions. Our Insights platform provides an inventory of hundreds of projects and developers, offering an insider’s view of the market to ensure our clients receive the best possible deal.

Where can you sign a VPPA?

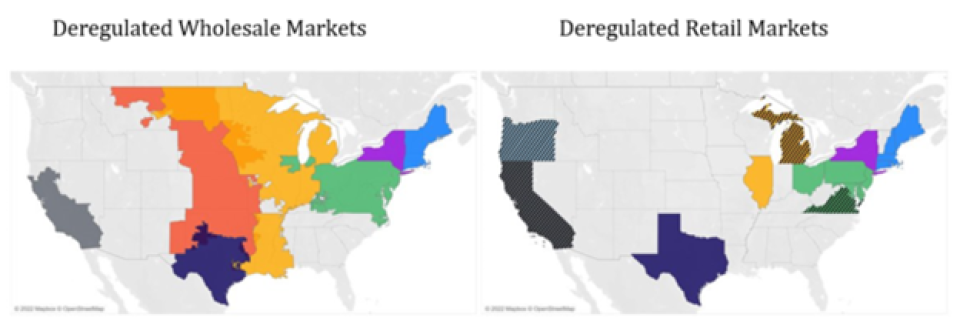

One of the major benefits of VPPAs is that they do not need to be located within the same wholesale electricity market as the offtaker’s energy consumption. However, the regulatory status of an area determines how renewable generators can sell power.

Renewable generators located in deregulated wholesale markets can sell renewable electricity via VPPAs. Renewable generators located in deregulated retail markets can sign physical PPAs. Some retail markets (OR, CA, VA and MI) are deregulated on a limited basis. For more details on retail renewable energy options within deregulated markets, be sure to check out our recent blog article. Additionally, it can tell a better impact story to source renewable energy from within the same grid where demand is located.

Summary:

- Renewable energy developer begins developing a project

- The developer signs a VPPA with a future offtaker in which the offtaker agrees to pay a fixed price for a specified volume

- The developer receives financing to complete construction of the project because of the VPPA

- Once the project is fully developed and becomes operational, the energy is sold into the local wholesale energy market at the floating market price

- At the end of the settlement period, the buyer will either pay the seller or receive a credit from the seller, depending on whether the floating market price was below or above the fixed price

- The buyer receives one REC for every MWh of output from the associated project