Understanding the Low-Carbon Fuel Standard: A Path to Sustainable Transportation

By Navodi Athapaththu, Senior Analyst, Electric Vehicle Strategy

Has your organization been wondering about all the buzz around leveraging low-carbon credits? Or whether your company could benefit from utilizing those credits to help offset electric vehicle (EV) charging costs?

The Low Carbon Fuel Standard (LCFS) is an innovative policy designed to promote the production and use of cleaner transportation fuels. For fleets, facilities, and charging station owners, the LCFS program provides an opportunity to generate revenue and lower operating costs from the sales of LCFS credits by operating EVs and charging stations.

In this blog post, we’ll delve into the concept of the LCFS, how it works, and how California's transportation fuel pool (the aggregate of all transportation fuels consumed within the state of California) can participate in this program.

The LCFS

The LCFS is a regulatory mechanism designed to reduce the carbon intensity of transportation fuels by encouraging the production and use of lower-emission fuels than the standard gasoline or diesel fuels. By incentivizing the use of lower-carbon and renewable fuels, the LCFS aims to diversify energy sources, promote renewable energy, and mitigate climate change. Fuel types that are eligible for this program include:

- Hydrogen

- Natural gas

- Renewable Natural Gas (RNG)

- Electricity

This standard, first implemented by California in 2009, has since been adopted by Oregon, Washington, and British Columbia (Canada), with multiple other jurisdictions in various stages of policy development.

In California, the current LCFS requires a 20% reduction in carbon intensity of transportation fuels by 2030.

How the Program Works

The LCFS is implemented through a market-based credit system. Here's an overview of how the elements of the program work:

Carbon Intensity Calculation: Fuels are assigned a carbon intensity value based on their lifecycle greenhouse gas emissions. Transportation fuels such as electricity, natural gas, RNG, and hydrogen generally have a lower carbon intensity than gasoline and diesel.

Compliance Obligations: Fuel producers, refiners, and importers must meet specific carbon intensity targets by either blending lower-carbon fuels into their product mix or purchasing credits from providers of cleaner fuels.

Credits and Deficits: Producers of cleaner fuels generate credits¹, while those with higher carbon-intensity fuels may have deficits. Credits can be sold to those with deficits, creating a market incentive for cleaner fuels.

Participants in the LCFS Program

Fuel producers, refiners, and importers are regulated under the LCFS and are mandated to lower the emissions of the fuels they produce or purchase credits to offset those emissions.

Organizations that own and operate charging stations for EV usage can voluntarily participate in this program as credit generators, which allows them to generate credits from EV charging station usage. These credits can then be sold to regulated entities that need to meet compliance obligations. The sales from the LCFS credits can be used to lower operating costs, cover electricity costs, or lower upfront investment costs from the deployment of EVs and charging stations.

How Fleets or Charging Station Owners Can Get Started

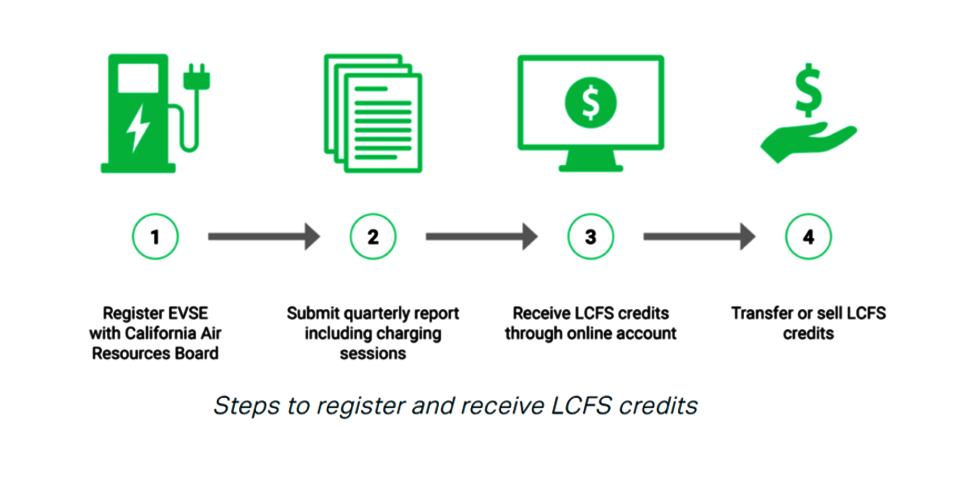

Organizations can work directly with the California Air Resources Board (CARB) to register their charging stations and/or EVs, submit quarterly usage reports, and trade credits. The data required within the quarterly reports typically includes fuel transactions, proof of compliance, and the voluntary pledge of credits for sale into the Credit Clearance Market. There are also a variety of third-party brokers, aggregators, and managers who can facilitate the process for a fee.

Register -> Report -> Credit -> Transfer/Sell

As the LCFS is a market-based credit trading system, credit prices can fluctuate based on the supply and demand of credits available. One heavy-duty, on-road, electric Class-8 truck operating 60,000 miles annually and at the current average credit value of $75 can generate an estimated $19,000 per year.

The Future of the LCFS

The California LCFS is currently undergoing rulemaking to make changes to the program. Due to its popularity, there has been significant activity from all parties in its future development, while CARB is planning to accelerate the targets to lower transportation fuel emissions.

Washington, Oregon, and British Columbia have active programs that mirror California’s, although there are nuances to its version of the program. New Mexico is the latest state to join, passing its own LCFS program in January 2024.

New York, Michigan, Minnesota, and Massachusetts are at various legislative stages to pass their own versions of the program, heavily adopting parts of the California LCFS.

Impact of the LCFS

The impact of LCFS on corporate fleets can vary depending on several factors, such as the nature of the fleet, the availability of low-carbon fuel options, and the regulatory environment. The most significant impact of the LCFS to charging station owners and fleets looking to electrify is financial support. The LCFS can help lower operational costs, even covering electricity costs by generating LCFS revenue.

- Generating LCFS revenue - To earn LCFS revenue, corporate fleets must be registered as a regulated party in the LCFS Reporting Tool and the Credit Bank & Transfer System (LRT-CBTS). Charging partners may already be registered and can register new charging stations on behalf of a fleet to streamline the process. If fleets are interested in claiming zero-carbon electricity, they can also work with a third party that specializes in renewable energy credits.

- Zero-carbon electricity for fleets - Corporate fleets can claim zero-carbon electricity by retiring renewable energy credits (RECs) equivalent to the amount of energy used for EV charging. Each REC represents 1 MWh of clean energy generated from a specific project. Companies that specialize in renewable energy credit trading have built automated transaction platforms, making it seamless for fleet managers to register their fleet, purchase RECs, and receive additional LCFS revenue.

While the LCFS has been successful in promoting cleaner transportation fuels, it is not without its challenges. These include concerns about the availability and scalability of certain low-carbon fuels, potential economic impacts on traditional fuel industries, environmental justice impacts, and the need for ongoing policy refinement.

Trio can help your organization learn more about how to incorporate LCFS into your transportation electrification and sustainability strategies. This includes conducting assessments, identifying opportunities for emissions reduction, advising on the adoption of lower-emission fuels, assisting with compliance obligations, and advising on strategy for credit generation programs such as EV charging station usage. Trio can provide targeted assistance and strategic recommendations on leveraging revenue from LCFS credits to lower operational costs and accelerate the deployment of EVs and charging infrastructure. For inquiries or to initiate collaboration, please reach out to information@trioadvisory.com.

¹Each LCFS credit represents one metric ton (MT) of CO2 reduced